How Loan Calculators Help You Avoid Costly Financial Mistakes

Thinking of applying for a home loan, personal loan, or car loan? Before you sign anything, there’s one free tool that can help you make better choices and save money in the long run — a loan calculator.

Whether you’re borrowing for the first time or looking to refinance, loan calculators are essential for comparing options, predicting future payments, and spotting hidden costs.

What Is a Loan Calculator?

A loan calculator is an online tool that helps you estimate your monthly payments, total interest payable, and the full cost of your loan — based on the amount you borrow, the interest rate, and the loan tenure.

Try our Loan EMI Calculator to instantly break down your loan into manageable parts.

1. Understand the True Cost of a Loan

It’s easy to get distracted by just the interest rate or the EMI. But what really matters is how much you’ll end up paying in total. A loan calculator shows:

- 📌 Your monthly EMI (Equated Monthly Installment)

- 📌 Total interest you’ll pay over the loan tenure

- 📌 The overall cost of the loan (principal + interest)

This gives you a crystal-clear picture of your financial commitment — no surprises later.

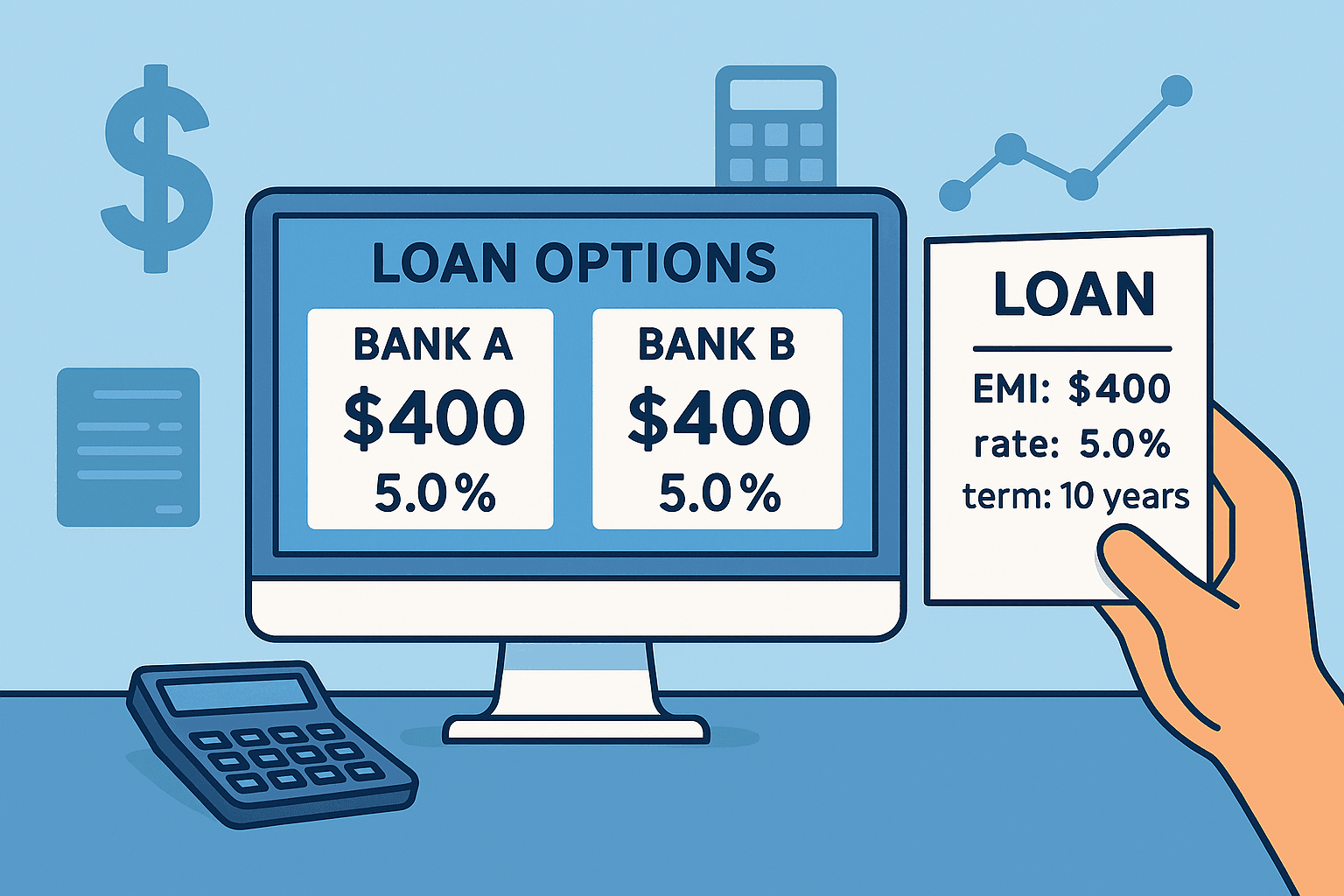

2. Compare Loan Offers Side-by-Side

Let’s say two banks offer similar interest rates, but different processing fees or tenures. How do you decide which is better? A loan calculator lets you compare scenarios side-by-side by adjusting the:

- 🔢 Loan amount

- 📉 Interest rate

- ⏳ Loan term (in years or months)

You’ll quickly see which option costs less in the long run.

3. Choose the Best Repayment Tenure

Longer tenures reduce your EMI, but increase total interest. Shorter tenures mean higher monthly payments, but less interest paid overall. A loan calculator helps you find the sweet spot between affordability and total cost.

ClearTax’s EMI guide explains how tenure impacts your repayments.

4. Plan Your Budget Before Borrowing

Loans should fit into your lifestyle — not control it. By using a loan calculator in advance, you can plan your EMIs around your monthly budget. It ensures your other expenses like rent, groceries, and savings aren’t sacrificed.

- Use our Monthly Budget Calculator to stay on track.

5. Reduce Risk of Default or Late Payments

One of the most common reasons for missed payments is underestimating EMIs. With a calculator, you’ll always know your commitment before you borrow. This reduces stress, protects your credit score, and helps you avoid penalties.

Advanced Features to Look For in Loan Calculators

Not all loan calculators are created equal. Here’s what makes a good one great:

- ✔️ EMI chart or amortization schedule

- ✔️ Option to include prepayment or part-payment

- ✔️ Monthly vs. yearly payment toggle

- ✔️ Dynamic updates as you adjust sliders

We’ve included all of these in our modern EMI calculator.

Conclusion: Don’t Take a Loan Without This Tool

Loans can be powerful financial tools — if used wisely. A loan calculator ensures you make informed decisions by showing you the real numbers behind the loan. It removes guesswork, reduces risk, and helps you borrow smart.

📊 Thinking about taking a loan? Use Our Free EMI Calculator Now